With all the convenience of credit cards and buy before you pay available today, it’s all too easy to fall into the trap of living beyond your income. But what does this convenience really cost you?

Jaxon graduated TAFE at 20 and found an administration job with a transport company. He immediately applied for a credit card, embracing the convenience of online shopping, streaming subscriptions, and tap-and-go facilities, and finally, he could join his friends at concerts, ski weekends, and Bali holidays.

His credit card soon maxed-out at its $5,000 limit. Jaxon was shocked at how quickly his spending had added up. Even without adding to those initial purchases, it cost over $900 in interest to pay the card off over the next two years.

While repaying his credit card debt over those two years, he was unable to save any additional money, so when Jaxon bought a car, he borrowed the entire $20,000.

Jaxon’s loans and credit card meant that his pay was spent before he received it. He began to see interest on borrowings as a fact of life, never considering how much it was costing him.

Five years later, having repaid his debts, Jaxon decided to upgrade his car, this time borrowing $40,000.

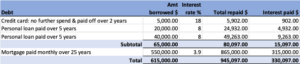

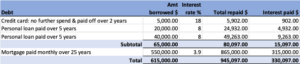

The chart below shows the amount of interest Jaxon had paid before he turned 30. In ten years, Jaxon had paid over $15,000 in interest.

When eventually he bought his first home, his interest payments really blew out.

Presumably, Jaxon will buy several cars and another home or two over his lifetime; he could easily end up paying more than a million dollars in interest alone.

When buying assets, and creating a lifestyle, interest often can’t be avoided, but with planning, it is possible to reduce the amount you pay.

At 20, when Angela took out a credit card, she insisted on the lowest credit limit possible and ensured she paid the full card balance each month. The low credit limit meant she’d have money available for emergency purchases, but never more than she could easily repay in a couple of months.

Her parents introduced her to their financial adviser. With the assistance of an online budgeting app, Angela implemented a budget that suited her lifestyle. She also established a separate savings account and asked her employer to direct a set amount into it each pay. She didn’t miss the money, and her budget helped her stay on track with card payments and mindful spending outside her weekly essentials.

After a year of saving, Angela bought her first car. With her savings, she only needed to borrow $10,000. As her repayments were easily managed, she continued saving. With the assistance of her financial adviser, she even managed to also invest some of her savings.

Using her savings and income from her investments, Angela eventually upgraded her car, but only needed to borrow $15,000.

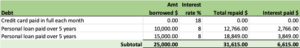

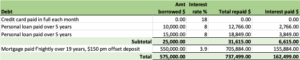

The chart below shows that over ten years, Angela paid significantly less interest than Jaxon but had made the same purchases.

When Angela was ready to purchase a house, she opted to make fortnightly repayments instead of monthly, and the money she’d previously deposited into her savings plan now went into a mortgage offset account.

Mortgage offsets can be a great way to reduce the loan period and the interest paid over the course of the loan.

Consequently, Angela ended up paying considerably less interest than Jaxon. This was no accident.

Early on, Angela had budgeted, saved, and invested, and structured her loans to work in her favour. Instead of relying on her credit card, Angela lived mindfully, saved, and paid cash wherever possible.

Additionally, Angela and her financial adviser regularly reviewed her financial position to ensure her financial arrangements continued to meet her needs.

Few of us can purchase big-ticket items without borrowing. Interest is the price we pay for those things that facilitate our chosen lifestyle. But while interest may be necessary, we really can take control of our finances and ensure we don’t pay more than we need to.

The information contained in this article is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional. We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.

www.finder.com.au Compare personal loans Australia (26 October 2022)

www.moneysmart.gov.au Loan calculators

www.loans.com.au Offset calculator