We anticipate a difficult and volatile year ahead in investment markets.

At a time of record government and consumer debt levels, 2022 saw the return of persistent inflation for the first time in 40 years, with central banks pushing up rates to levels that deliberately slowed economic activity. This was exacerbated by geopolitical factors that significantly disrupted supply chains and sent energy prices soaring. The UK debt crisis also showed that investors are concerned about the management of the massive levels of global debt.

The result was the biggest market storm in decades. Global stocks finished the year down 18% in US dollar terms (down 12.5% in AUD terms) and making things worse, for the first time in decades, bonds also fell as they were unable to offer either income or diversification benefits, with global bonds (hedged) ending the year down 12%.

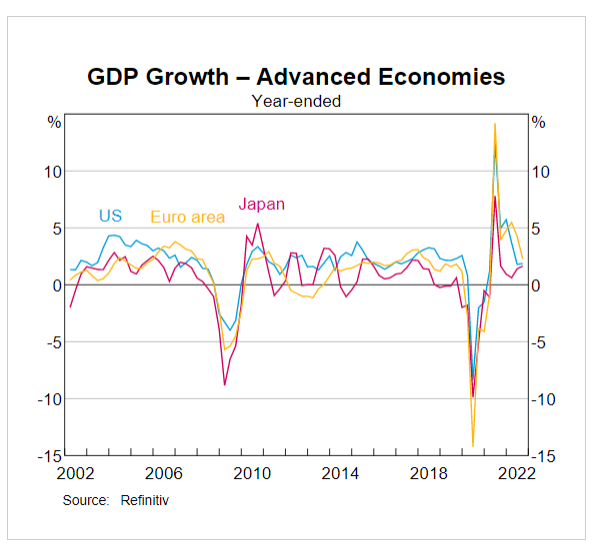

We entered 2023 with global growth and money supply falling rapidly in developed markets and key leading indicators of economic growth in recessionary territory.

While stock markets have had a good start this year, we envisage a US lead global recession in 2023. However, we believe the chances of the recession being a deep one, such as in 2008 as low to moderate. That recession lasted for 16 months and global GDP and stock markets fell heavily. Our base case envisages an average recession in the US where GDP growth is negative 1-2%; earnings fall by another 5-15% from current levels and the S&P500 falls by 15-25% from current levels. Further, we expect most economies to follow the US into recession, with varying degrees of severity and timings. On a positive note, we anticipate a recovery in the markets likely to at least have started in the second half of 2023, which may result in the markets producing a moderately positive or negative return this calendar year.

The actions of the US Federal Reserve in a recession will determine how quickly any recovery occurs. In Australia, unlike in the US, inflation continues to rise, meaning that interest rates here are likely to rise and be held at high levels, even if the US Fed reduces interest rates earlier than expected. The recovery in the Chinese economy is however a positive for the global economy, especially for commodity producers like Australia.

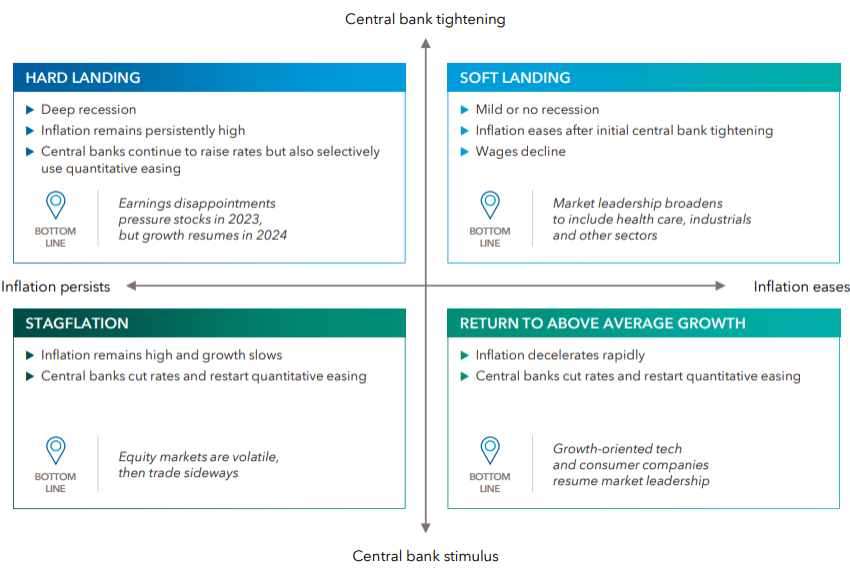

Preparing for a range of possible outcomes

The chart below from Capital Group shows the complexities of investing in 2023. As can be seen, it boils down to two questions: How persistent will inflation be? and Where are interest rates headed? Added to this, central banks around the world are following different paths, leading to a wide range of outcomes.

We see a US recession and associated fall in stock prices around the world for the following reasons:

- inflation remains elevated in Australia and the US, partly due to record labour shortages, especially in the US, and although goods costs are falling, services inflation remains high;

- the Fed is unlikely to cut interest rates until at least late 2023 as they will want to avoid inflation returning in 2024; • global money supply is at low levels at present, which does not support financial assets in the near term;

- global central banks are actively tightening monetary conditions;

- investor, business, and consumer confidence are at near record lows;

- a recession is not fully reflected in current stock prices and valuations, particularly for an average or deep one.

Market recovery and upside potential

In this environment, we do not expect the Australian Stock Exchange (ASX) to outperform significantly (as it did in 2022), because the value stocks that dominate the ASX, especially materials and banks, do not traditionally perform well in global recessions. While the Fed may be considering reducing rates, the RBA is holding rates at a relatively high level, making conditions difficult for home-owners and borrowers. However, the recovery in China is positive for Australia.

Analysis shows that since 1950, recessions are not very long, averaging 10 months. Importantly, while stock markets typically lead the economy into downturns, history shows that they rebound about 6 months before the economy recovers. This may occur in mid to late 2023. In the second half of 2023, markets may begin to factor in a recovery in company earnings. Depending on forward PE assumptions, the upside potential for the S&P 500 could be around 4150 after the recessionary impact.

Managing your portfolio

Flexibility is paramount. Until last year, portfolio construction could be largely set and forget, as both stocks and bonds did well due to fiscal stimulus and interest rate falls. We believe that going forward, stock market and listed property returns will be lower and more volatile. On the positive side, we see opportunities in defensive asset classes, such as bonds and investment grade corporate debt. Overall, the construction of portfolios in each asset class needs to be flexible. As this cycle plays out, opportunities will emerge and disappear relatively quickly.

Conclusion

The economic conditions ahead over the next few years and the implications for investment markets will be challenging. Greater market volatility means we will be working hard to assess market conditions, make appropriate portfolio changes, and seek to capture opportunities. Our role as your professional financial adviser is to continue to educate and inform you with respect to market conditions and ensure that your portfolio continues to meet your investment needs, objectives, and circumstances. Quality financial advice will give you confidence that your investments are well looked after, despite a potentially bumpy road ahead.

The information contained in this article is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional. We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.